News and Notes from The Johnson Center

In-Network versus Out-of-Network Coverage....What's the Difference?

JCCHD | Tue, June 02, 2015 | [Autism Treatment]In our recent webinar, NAVIGATING INSURANCE, we discussed the difference between in-network and out-of-network insurance services. In-network coverage is when your insurer negotiates with a wide range of doctors, specialists, hospitals, labs, and pharmacies to pay a set price for services. These are then the providers in your “network.” Your insurance provider will typically pay a higher percentage of your claim if you go to in-network clinicians. Typically you will have a set co-pay to see in-network providers, and those providers agree to only charge you those set rates.

You may find that you need to see specialists who are outside of your network. Many times, patients will travel to different cities and states to find a specialist for their particular needs. Sometimes the specialty clinics are not contracted with any insurance carriers and the patient (or their parents/caregivers) pay the full amount at the time of service. Many insurance policies will cover out-of-network providers, but they have not agreed to any set rates and they will sometimes only pay a percentage of the costs. Your plan may require higher co-pays, deductibles, and co-insurance for out-of-network care.

It’s less common that your plan will not cover out-of-network care at all, leaving you to pay the full cost yourself. It’s imperative that you check with your insurance carrier prior to any clinical visit to understand the coverage your insurer provides, whether it’s in-network or out-of-network.

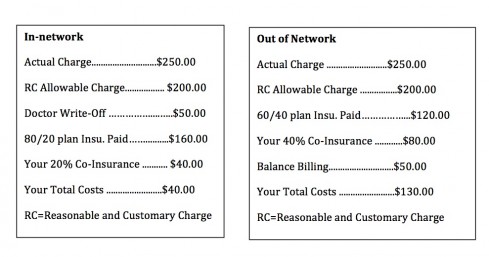

Following is an example that outlines how the same appointment is billed differently, depending on the in-network or out-of-network coverage. Do your homework and you’ll know what to expect from your insurance policy!